Interest Rates

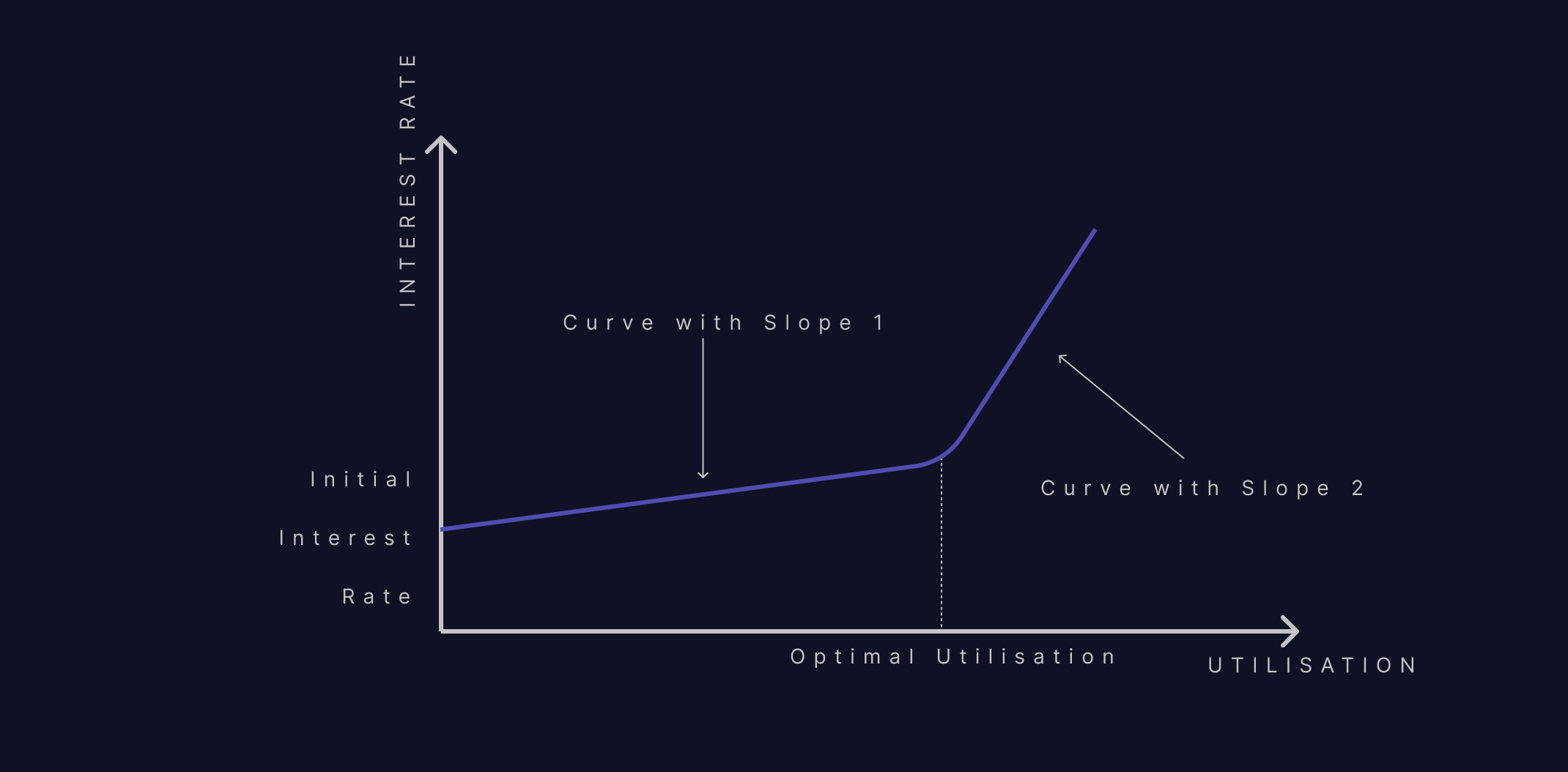

The Red Bank operates with a standard two-slope interest rate model (see Fig. 7). Pioneered by Aave and Compound, this model is battle-tested and widely used throughout DeFi. It works by targeting a certain utilisation rate (amount borrowed / amount deposited). Then, a curve is derived and implemented that aims to discourage utilisation past the optimal level by a sharply increasing slope, i.e. a sharply increasing interest rate.

These parameters reflect the perceived riskiness of the asset in question and is determined by the Martian Council using the asset listing risk framework.